Review Credit Reports for Faults: Your “undesirable” rating may be the result, at least partly, of faulty information on your credit score experiences. So Examine your latest credit rating report for things such as accounts you didn’t open and on-time payments mistakenly stated as late.

If you make an application for credit score, obtain credit score approval, and/or close a loan, or normally all through loan processing, your preferred Company, or top lender, will carry out a hard credit pull. For in-depth facts certain towards your decided on Service provider or supreme lender, please overview any disclosures your chosen Supplier or best lender provides to you.

670 credit score671 credit score672 credit score673 credit score674 credit score675 credit history score676 credit history score677 credit history score678 credit rating score679 credit rating score680 credit score score681 credit score682 credit score683 credit history score684 credit rating score685 credit rating score686 credit score score687 credit score688 credit history score689 credit rating score690 credit score score691 credit score score692 credit score693 credit rating score694 credit history score695 credit history score696 credit score score697 credit score score698 credit score699 credit rating score700 credit score score701 credit history score702 credit score score703 credit score704 credit history score705 credit rating score706 credit rating score707 credit score score708 credit score709 credit history score710 credit score score711 credit score712 credit score713 credit history score714 credit score score715 credit history score716 credit rating score717 credit history score718 credit score score719 credit score720 credit rating score721 credit score722 credit rating score723 credit score724 credit rating score725 credit rating score726 credit history score727 credit score score728 credit score score729 credit history score730 credit score score731 credit history score732 credit score733 credit rating score734 credit history score735 credit score736 credit score score737 credit rating score738 credit rating score739 credit history score

We have calculated this according to publicly available information and facts with the lender and your search phrases. The loan expenses may range dependant upon the loan volume, loan period, your credit rating background, along with other elements.

There aren’t several lenders that take programs from borrowers with credit score scores of 550. On the other hand, there are lenders who enable for any co-signer—somebody that agrees to repay the loan if the principal borrower are unable to—which may help you qualify for your loan that has a rating of 550.

Alternatively, you can prequalify for loans via a web based loan marketplace. Using a loan Market can expedite the procedure by displaying you various presents following publishing one variety.

If you select a thirty-year property finance loan, you'll have reduce regular payments. Nonetheless, the loan will cost additional in interest by the time you pay back it off.

Disclaimer: Editorial and person-produced material is not delivered or commissioned by economical institutions. Opinions expressed here are the writer’s alone and read more possess not been accredited or in any other case endorsed by any financial establishment, which includes those that are WalletHub advertising and marketing companions.

Payday loans occur with a few downsides that installment loans don’t have – That could be a payday loan is anticipated being paid out back again typically inside of 1-2 weeks in entire.

When making use of for just a $35,000 loan, lenders will contemplate your money and credit score to ascertain your power to repay the loan, but you will find other qualifications and techniques you’ll want to keep in mind.

Obtaining said that, you will discover a few selections. You are able to be extra as a licensed person on someone else’s bank card. Alternatively, you may apply for a secured credit card.

Of each of the loan kinds listed below, automobile loans are Probably the least complicated to have having a lessen credit rating rating. On the other hand, you'll be able to expect to pay for significantly increased desire by using a subprime credit score as opposed with the common borrower.

Normally Spend in time Transferring Ahead: Payment heritage accounts with the lion’s share of your credit score, and each month provides a fresh chance to increase With this regard.

Make a decision if you need the loan now. If you can hold out several months or months, you'll be able to work to put yourself in a far better posture to get out a loan. Over that time period, you could boost your credit history.

Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Tiffany Trump Then & Now!

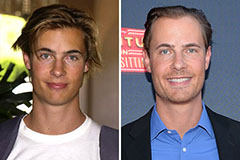

Tiffany Trump Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!